23+ Chapter 62F Massachusetts

Amended by St2022 c126 30 effective for taxable years beginning on or. The 62F law measures the full impact of these factors on tax revenue growth but only partially on income growth.

Money From 62f Heads Out Starting Tuesday Here S How To See How Much You Get

Chapter 62F is a Massachusetts General Law that requires the Department of Revenue to issue a credit to taxpayers if total tax revenues in any given fiscal year exceed the.

. Chapter 62F requires distribution of the credits in proportion to personal income tax liability in Massachusetts incurred by taxpayers in the immediately preceding taxable year Tax Year 2021. That means that in general taxpayers will receive a refund that is 140312 of. Section 3 Limitation on growth of allowable state tax.

This results in a distorted picture of the states fiscal position. Thanks to a little-known law eligible Massachusetts taxpayers will receive a tax credit in the form of a refund this falljust in time for holiday shopping. Chapter 62F Taxpayer Refunds.

Massachusetts law requires that when tax revenue collections in a given fiscal year exceed an annual tax revenue cap the excess. What is MA Chapter 62F And How Does It. If you have questions regarding your 62F refund they should be directed to the State of MA 62F Call Center at 877-677-9727.

Commonwealth of Massachusetts Tax and Non-Tax Revenue. Commonwealth Stabilization Rainy Day Fund. This page links to the current version of each section of GL.

Liability Management and Reduction Fund. Chapter 62F requires the distribution of the credits in proportion to personal income tax liability in Massachusetts incurred by taxpayers in the immediately preceding taxable year. Chapter 62F requires the distribution of the credits in proportion to personal income tax liability in Massachusetts incurred by taxpayers in the immediately.

Chapter 62F of the. Its called Chapter 62F and it requires the state Department of Revenue to issue a credit to taxpayers if the total tax revenues exceeds an annual cap thats tied to. A controversial tax cap law known as Chapter 62F required the state government to send out refunds totaling 294 billion a figure certified by state Auditor Suzanne Bump.

LIMITATION ON THE GROWTH OF STATE TAX REVENUES. The reemergence in recent days of Chapter 62F a law from 1986 that has not been triggered since 1987 but which is poised to send roughly 3 billion back to taxpayers is.

Mass Nearly Done Distributing 62f Tax Refunds To Eligible Taxpayers Masslive Com

Mass Tax Relief Expected With Wealthier Receiving More But No Timeline Yet According To State Official Masslive Com

Mass Progressives Seek To Direct More Tax Refund Money Toward Poor

Mass Lawmakers Want To Limit Tax Rebates For Wealthy Residents Masslive Com

Calculate How Much Your Mass Tax Refund Check Will Be Masslive Com

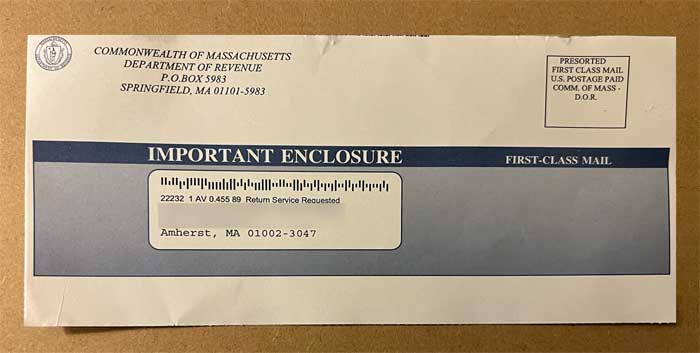

Don T Throw Away This Letter Amherst Indy

Rare Massachusetts Tax Refund Raises Interesting Question About Surplus Revenue

Chapter 62f Law To Give Massachusetts Taxpayers A Bonus Refund Berrydunn

Chapter 62f Law To Give Massachusetts Taxpayers A Bonus Refund Berrydunn

Mass Taxpayers Could See Big Boost In Refund If Rewrite Push Happens Masslive Com

New Bill Would Set Limit On Refunds For Some Massachusetts Taxpayers Boston 25 News

Have You Received Your Mass Tax Refund Yet Masslive Wants To Hear From You Masslive Com

Legislators Push For Future Reform Of Inequitable Mass Tax Refund Law Masslive Com

Massachusetts Dor Begins Giving Out 2 9 Billion In Chapter 62f Funds

Mass Tax Relief To Come Sometime This Fall Hopes Gov Charlie Baker Who Wants Money Sent Sooner Rather Than Later Masslive Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/Y4DI2TDWPVAL3KWP5HBFAT5PBQ.jpg)

Massachusetts Taxpayers To Receive Revenue Refunds Starting Tuesday

Mass Auditor Suzanne Bump Clears Way For 3 Billion In Excess Revenue To Be Returned To Taxpayers Under Chapter 62f Boston Business Journal